In review: The Care Sector

The UK Care market is experiencing a period of growth in terms of mergers and acquisitions (M&A), with Bureau van Dijk reporting a 12% increase in the number of completed deals within the sector over the past two years.

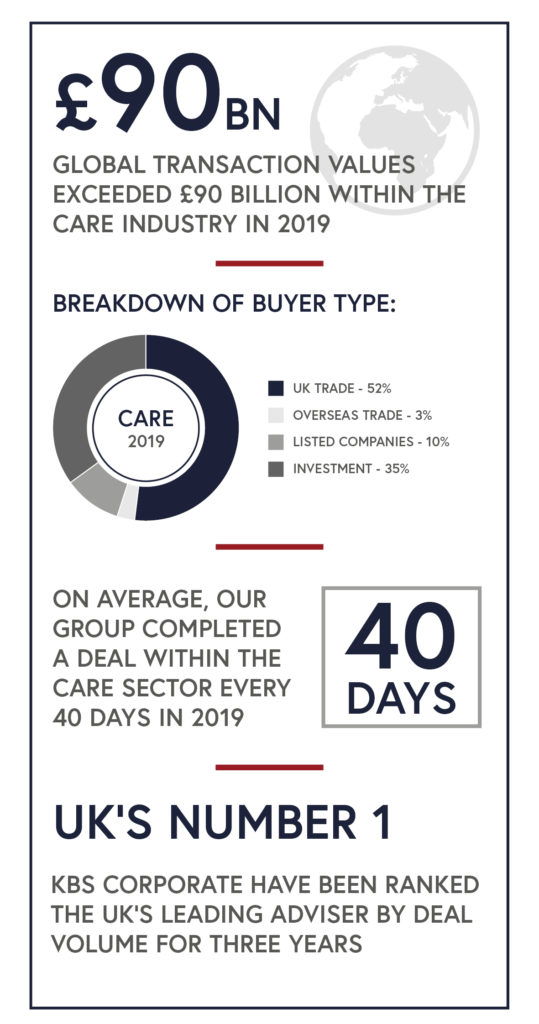

UK businesses within the care industry commanded over £90 billion in transaction values last year, with one third of those companies receiving inward capital from investment acquirers, whilst the UK was also the third most popular acquisition target globally within the sector.

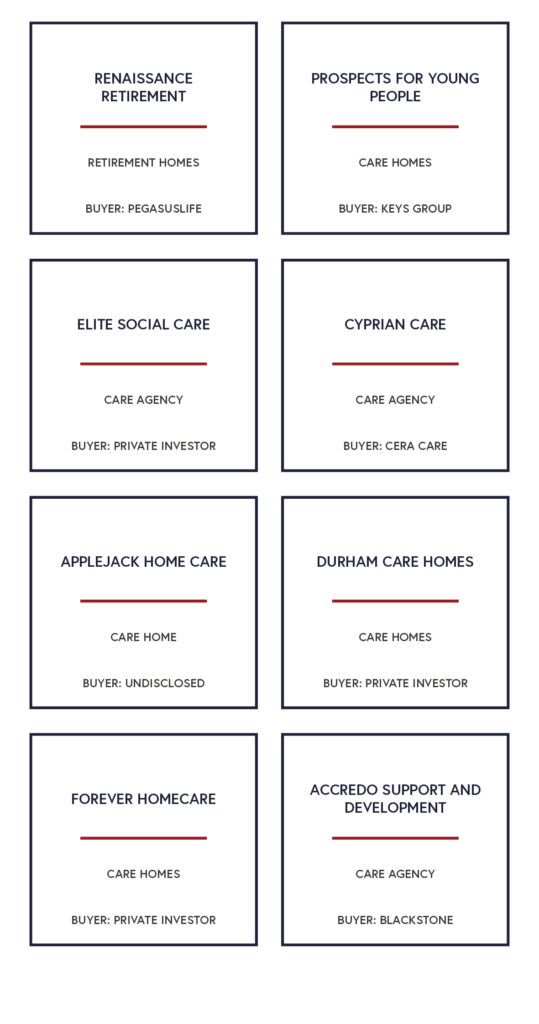

Private Equity activity within the sector is high, with investors such as Business Growth Fund and NVM Private Equity each adding to their care portfolios over the past three years, whilst interest from large trade buyers and PLCs has seen Caretech, SevaCare and HC-One each make several key acquisitions within the sector recently.

The outlook for the sector is positive, and we fully expect dealmaking to remain strong as we continue to retain active buyers looking for suitable acquisitions.

UK businesses are set to benefit from the investment of Private Equity capital that is currently standing at $1.5 trillion globally and UK PLC cash reserves in excess of £850 billion.

At KBS Corporate, we completed an average of one deal every 40 days within the care sector last year. This was achieved on our way to being named the UK’s most active adviser by deal volume for the third year running, completing over 20% more deals than any other buyer.

Our ‘TripleTrack’ approach explores a full or partial sale by targeting trade buyers, Private Equity buyers, or for relevant businesses, an IPO. This, coupled with unparalleled buyer reach, incorporating an effective blend of big data, proprietary technology and experienced researchers to target buyers across the Globe, puts us in the prime position to explore every possible avenue to build a deal to meet each client’s objectives.

We strive to continuously enhance our services and significantly invest into quality resources in order to become even better at finding buyers and maximising opportunities for our clients. Our success of last year resulted from record levels of interest from acquirers, with an increase of almost 30% in the number of prospective buyers being sourced, resulting in an uplift of buyer meetings of 42% and, ultimately, a record number of offers secured for our clients (up 34%).

Sources: Bureau van Dijk, Preqin, K3 Capital Group